A commonly-asked question about the CPCU® program is what order you should take the classes in. Since none of the classes have a prerequisite, you can take them in whatever order you want. That said, we recommend taking CPCU 520 (Insurance Operations)right before CPCU 540 (Finance & Accounting for Insurance Professionals)for these reasons: Why she had to go to the duke read online.

#1: You'll learn key terminology & concepts in CPCU 520 that are used in CPCU 540

CPCU 520 — Insurance Opera-tions, is one of multiple courses required to complete the CPCU designation. Visit The Institutes website www.theinstitutes.org for details on the required courses. In CPCU 520 you will learn to: Understand the impact of your business decisions by knowing how different func-tional areas operate and col. A special set of cards dedicated to 520 formulas. CPCU 520: Formulas study guide by cydley includes 41 questions covering vocabulary, terms and more. Quizlet flashcards, activities and games help you.

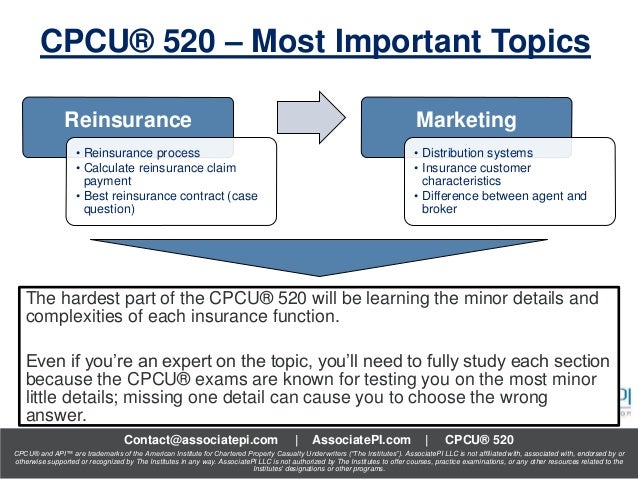

CPCU 520 examines how an insurance company works by taking a detailed look at each of the main departments or functions of an insurance carrier, such as claims, underwriting, reinsurance, etc. Many of the terms you are introduced to in CPCU 520 are used in the discussions throughout CPCU 540, so already knowing the vocabulary means you don't have to stop to look things up. And, when they discuss how a certain department's activities could impact an insurance company's financials, you'll already have an understanding or frame of reference for the activities they are referring to because you already learned about those departments in CPCU 520.

Make sure you review the SMART way for your CPCU exam!

Each CPCU course covers a TON of material, and having a way to efficiently review it all to refresh your memory is CRUCIAL to passing your exam. Sigmaplot 13 serial number crack bandicam. Our famous study guides are the perfect way to quickly and easily brush up on all the key concepts before it's time to take your test, WITHOUT having to reread all the material again. Just look at the difference below:

#2: CPCU 520 includes an entire chapter on insurance regulation, which is a driving force behind financial reporting requirements

You'll come to realize in CPCU 540 that governments heavily regulate how insurance companies are required to track and report their financial information. Most of CPCU 540 is explanations of how certain financial reporting requirements satisfy what the government is trying to accomplish with their insurance regulations. Chapter two of CPCU 520 is devoted entirely to the reasons for government regulation, so it provides a great introduction for better understanding the 'why' behind all the financial reporting guidelines covered in CPCU 540.

#3: CPCU 520 already introduces to you how an insurance company operates financially

In CPCU 520, you'll learn the basics of how an insurance company makes money and what some of the key financial measures are that help you monitor an insurance carrier's performance. Again, what you learn about in CPCU 520 thus helps serve as a foundation to the much more detailed exploration you will make in CPCU 540.

#4: The same formulas from CPCU 520 appear again in CPCU 540

Many people are intimidated by the idea of memorizing and applying math formulas, and there are a lot of them in CPCU 540. But a good chunk of them are already included inCPCU 520, so it's basically like splitting the formulas into two sections if you do the courses one right after the other. Work on memorizing the formulas in CPCU 520, master them & pass that exam, then while they are fresh in your mind you can go right into CPCU 540 and finish memorizing the rest of them.

Cbtricks archive. Side note: we also have a separate blog post with a step-by-step plan for how exactly to tackle any CPCU formulas, which you can view by clicking HERE.

But, also consider this:

CPCU 540 is pretty challenging – it has a reputation as 'The Beast' for a reason. It will likely take more time and effort than you've had to invest for your prior courses, so plan accordingly!

Let us help you tackle CPCU 520 then CPCU 540!

But now you know how to leverage what you learn in CPCU 520 to improve your comprehension of CPCU 540.

CPCU 520 Study Guide e-Bundle – Only $24.99

- For use with 1st edition course of CPCU 520: Connecting the Business of Insurance Operations

- FREE updates (whenever we update our materials, you get access to the new version at no additional charge)

- Delivered by email as downloadable PDF

- For buyer's personal use only (non-transferrable and not for resale)

- Includes:

- Study guide

- BONUS: Formulas module

- BONUS: Formulas cheat sheet

- BONUS: How to Memorize CPCU Formulas

- BONUS: Comparison of Insurance Customers cheat sheet

- BONUS: Actuarial Word Problems worksheet

- BONUS: Types of Reinsurance chart

- BONUS: Reinsurance Practice Problems worksheet

Overall, there aren't any drastic changes. The textbook is riddled with wording changes and what appear to be new vocabulary terms, but closer examination reveals that most of the changes are superficial rewordings and the newly bolded terms were actually referred to in the second edition book (they just weren't previously designated as vocabulary words).

Virtually all of the significant changes are related to the use of technology. If you studied the technology chapters or sections from CPCU 500 and CPCU 540, you'll be very familiar with the new content in CPCU 520.

Below is a list of the most noteworthy section changes (chapter numbers & titles taken from the new second edition book):

Please note: We do not provide any guarantee or warranty that this is an all-inclusive list of the changes to the latest textbook.

Chapter 1 – Overview of Insurance Operations

- The Rise of InsurTech Companies (newly added)

- The Digitization of Insurance (newly added)

Chapter 2 – Insurance Regulation

- NAIC International Insurers Department (expanded slightly)

- National Association of Registered Agents & Brokers Reform Act of 2015 (newly added paragraph)

- Unofficial Regulators of Insurance (removed from 3rd edition)

Chapter 3 – Insurance Marketing & Distribution

- Internet Benefits & Challenges for Insurers table (removed from 3rd edition)

Chapter 4 – The Underwriting Function

- Purpose of Underwriting (removed from 3rd edition)

- Line Underwriting Activities (modified)

- Staff Underwriting Activities (modified)

Chapter 5 – Risk Control & Premium Auditing

- Technology's Growing Impact on the Survey Process (newly added)

- The Importance of Premium Auditing for the Insurer (newly added)

- Collect Ratemaking Data (expanded)

- Blockchain's Impact on Premium Auditing (newly added)

- Importance of Accurate Premium Audits (removed from 3rd edition)

Chapter 6 – The Claims Function

- How Blockchain Can Assist in Processing Claims (newly added)

- 6 methods of setting loss reserves (removed from 3rd edition)

- Setting Accurate Reserves Can Be Difficult (newly added)

- Investigating the Claim (modified)

- Documenting the Claim (newly added)

- Concluding the Claim (expanded)

Chapter 7 – Actuarial Operations

- An Illustration of Reserving Methods (removed from 3rd edition)

Chapter 8 – Reinsurance Principles & Concepts

- How Blockchain Could Change Reinsurance (newly added)

- Reinsurance Professional & Trade Associations (removed from 3rd edition)

- The Rise of Parametric Insurance (newly added)

- Reinsurance Program Design (removed)

Chapter 9 – Business Needs & IT Alignment

- Gain a Competitive Advantage (expanded)

- Transaction Processing Systems (entire section greatly modified)

- Electronic & Mobile Commerce (removed from 3rd edition)

- Mobile Devices (removed from 3rd edition)

Chapter 10 – Insurer Strategic Management

- Decline Mode Strategies (modified)

- Insurers' Global Expansion (removed from 3rd edition)

Please note that all CPCU 520 exams moving forward will be based on this new third edition, so be mindful if you are attempting to study with an older edition.

We've updated our study guide!

We've updated our CPCU 520 study materials to reflect the changes. Anyone who previously purchased our CPCU 520 bundle will be given access to the new version, free of charge.

Cpcu 520 Test

CPCU 520 examines how an insurance company works by taking a detailed look at each of the main departments or functions of an insurance carrier, such as claims, underwriting, reinsurance, etc. Many of the terms you are introduced to in CPCU 520 are used in the discussions throughout CPCU 540, so already knowing the vocabulary means you don't have to stop to look things up. And, when they discuss how a certain department's activities could impact an insurance company's financials, you'll already have an understanding or frame of reference for the activities they are referring to because you already learned about those departments in CPCU 520.

Make sure you review the SMART way for your CPCU exam!

Each CPCU course covers a TON of material, and having a way to efficiently review it all to refresh your memory is CRUCIAL to passing your exam. Sigmaplot 13 serial number crack bandicam. Our famous study guides are the perfect way to quickly and easily brush up on all the key concepts before it's time to take your test, WITHOUT having to reread all the material again. Just look at the difference below:

#2: CPCU 520 includes an entire chapter on insurance regulation, which is a driving force behind financial reporting requirements

You'll come to realize in CPCU 540 that governments heavily regulate how insurance companies are required to track and report their financial information. Most of CPCU 540 is explanations of how certain financial reporting requirements satisfy what the government is trying to accomplish with their insurance regulations. Chapter two of CPCU 520 is devoted entirely to the reasons for government regulation, so it provides a great introduction for better understanding the 'why' behind all the financial reporting guidelines covered in CPCU 540.

#3: CPCU 520 already introduces to you how an insurance company operates financially

In CPCU 520, you'll learn the basics of how an insurance company makes money and what some of the key financial measures are that help you monitor an insurance carrier's performance. Again, what you learn about in CPCU 520 thus helps serve as a foundation to the much more detailed exploration you will make in CPCU 540.

#4: The same formulas from CPCU 520 appear again in CPCU 540

Many people are intimidated by the idea of memorizing and applying math formulas, and there are a lot of them in CPCU 540. But a good chunk of them are already included inCPCU 520, so it's basically like splitting the formulas into two sections if you do the courses one right after the other. Work on memorizing the formulas in CPCU 520, master them & pass that exam, then while they are fresh in your mind you can go right into CPCU 540 and finish memorizing the rest of them.

Cbtricks archive. Side note: we also have a separate blog post with a step-by-step plan for how exactly to tackle any CPCU formulas, which you can view by clicking HERE.

But, also consider this:

CPCU 540 is pretty challenging – it has a reputation as 'The Beast' for a reason. It will likely take more time and effort than you've had to invest for your prior courses, so plan accordingly!

Let us help you tackle CPCU 520 then CPCU 540!

But now you know how to leverage what you learn in CPCU 520 to improve your comprehension of CPCU 540.

CPCU 520 Study Guide e-Bundle – Only $24.99

- For use with 1st edition course of CPCU 520: Connecting the Business of Insurance Operations

- FREE updates (whenever we update our materials, you get access to the new version at no additional charge)

- Delivered by email as downloadable PDF

- For buyer's personal use only (non-transferrable and not for resale)

- Includes:

- Study guide

- BONUS: Formulas module

- BONUS: Formulas cheat sheet

- BONUS: How to Memorize CPCU Formulas

- BONUS: Comparison of Insurance Customers cheat sheet

- BONUS: Actuarial Word Problems worksheet

- BONUS: Types of Reinsurance chart

- BONUS: Reinsurance Practice Problems worksheet

Overall, there aren't any drastic changes. The textbook is riddled with wording changes and what appear to be new vocabulary terms, but closer examination reveals that most of the changes are superficial rewordings and the newly bolded terms were actually referred to in the second edition book (they just weren't previously designated as vocabulary words).

Virtually all of the significant changes are related to the use of technology. If you studied the technology chapters or sections from CPCU 500 and CPCU 540, you'll be very familiar with the new content in CPCU 520.

Below is a list of the most noteworthy section changes (chapter numbers & titles taken from the new second edition book):

Please note: We do not provide any guarantee or warranty that this is an all-inclusive list of the changes to the latest textbook.

Chapter 1 – Overview of Insurance Operations

- The Rise of InsurTech Companies (newly added)

- The Digitization of Insurance (newly added)

Chapter 2 – Insurance Regulation

- NAIC International Insurers Department (expanded slightly)

- National Association of Registered Agents & Brokers Reform Act of 2015 (newly added paragraph)

- Unofficial Regulators of Insurance (removed from 3rd edition)

Chapter 3 – Insurance Marketing & Distribution

- Internet Benefits & Challenges for Insurers table (removed from 3rd edition)

Chapter 4 – The Underwriting Function

- Purpose of Underwriting (removed from 3rd edition)

- Line Underwriting Activities (modified)

- Staff Underwriting Activities (modified)

Chapter 5 – Risk Control & Premium Auditing

- Technology's Growing Impact on the Survey Process (newly added)

- The Importance of Premium Auditing for the Insurer (newly added)

- Collect Ratemaking Data (expanded)

- Blockchain's Impact on Premium Auditing (newly added)

- Importance of Accurate Premium Audits (removed from 3rd edition)

Chapter 6 – The Claims Function

- How Blockchain Can Assist in Processing Claims (newly added)

- 6 methods of setting loss reserves (removed from 3rd edition)

- Setting Accurate Reserves Can Be Difficult (newly added)

- Investigating the Claim (modified)

- Documenting the Claim (newly added)

- Concluding the Claim (expanded)

Chapter 7 – Actuarial Operations

- An Illustration of Reserving Methods (removed from 3rd edition)

Chapter 8 – Reinsurance Principles & Concepts

- How Blockchain Could Change Reinsurance (newly added)

- Reinsurance Professional & Trade Associations (removed from 3rd edition)

- The Rise of Parametric Insurance (newly added)

- Reinsurance Program Design (removed)

Chapter 9 – Business Needs & IT Alignment

- Gain a Competitive Advantage (expanded)

- Transaction Processing Systems (entire section greatly modified)

- Electronic & Mobile Commerce (removed from 3rd edition)

- Mobile Devices (removed from 3rd edition)

Chapter 10 – Insurer Strategic Management

- Decline Mode Strategies (modified)

- Insurers' Global Expansion (removed from 3rd edition)

Please note that all CPCU 520 exams moving forward will be based on this new third edition, so be mindful if you are attempting to study with an older edition.

We've updated our study guide!

We've updated our CPCU 520 study materials to reflect the changes. Anyone who previously purchased our CPCU 520 bundle will be given access to the new version, free of charge.

Cpcu 520 Test

Cpcu 520 Textbook Pdf

CPCU 520 Study Guide e-Bundle – Only $24.99

- For use with 1st edition course of CPCU 520: Connecting the Business of Insurance Operations

- FREE updates (whenever we update our materials, you get access to the new version at no additional charge)

- Delivered by email as downloadable PDF

- For buyer's personal use only (non-transferrable and not for resale)

- Includes:

- Study guide

- BONUS: Formulas module

- BONUS: Formulas cheat sheet

- BONUS: How to Memorize CPCU Formulas

- BONUS: Comparison of Insurance Customers cheat sheet

- BONUS: Actuarial Word Problems worksheet

- BONUS: Types of Reinsurance chart

- BONUS: Reinsurance Practice Problems worksheet